Cruise Travel Insurance

If you're planning to take to the sea, don't forget to pack your cruise travel insurance. While you may have an ideal trip free from illness, injuries, mishaps, and delays, it's wise to prepare for potential misfortunes that could bring your good time to a grinding halt.

Cruise travel insurance could cover you if you sustain an injury on an island expedition or a common shipboard illness sweeps the cabins. Often referred to as "trip cancellation insurance," cruise trip insurance could also reimburse you if your cruise is unexpectedly delayed, canceled, or interrupted due to a covered reason.

Keep reading to learn more about what cruise insurance is, what it covers, and why it may be a wise investment for your high seas adventure.

Why Do I Need Cruise Travel Insurance?

A cruise is one of the most enchanting ways to see the world, but it's important to understand and prepare for the potential risks involved. Here are just a few reasons why you may need cruise insurance for your trip:

Cruises are often delayed due to unexpected weather conditions.

Unfortunately, cruise delays due to bad weather or fog are fairly common, and there's no guarantee your cruise line will compensate you for the meals and accommodations you have to pay for during a long delay (12+ hours).

Cruise ships can be hotbeds for stomach bugs.

For example, nearly 300 passengers on Princess Cruises’ Ruby Princess cruise ship fell ill with vomiting and diarrhea between February 26 and March 5, 2023. The likely cause of the gastrointestinal illness was norovirus, according to the cruise line.

Recreational activities in unfamiliar territory can result in injury.

As you explore each port, you'll likely want to participate in activities such as hiking, rock climbing, or beach volleyball. Unfortunately, these types of recreational sports and activities carry risk of injury.

Your cruise line's own insurance plan may not be the best cruise insurance for you.

The policy available through your cruise line may reimburse you for missed departures or weather delays, but coverage for important benefits like Medical Evacuation & Repatriation of Remains or Emergency Accident and Sickness Medical Expenses may be extremely limited—or excluded entirely.

Your regular health insurance may provide limited or no coverage in international waters.

If you don't have international health coverage as you travel outside your home country, you'll be solely responsible for medical expenses you incur on your cruise. That's why the Centers for Disease Control and Prevention (CDC) recommends travel medical insurance to those traveling on a global scale.

You may need to supplement your regular health insurance as you cruise the U.S.

Taking a domestic cruise in the U.S.? Travel insurance can supplement your regular health insurance if you are a U.S. citizen or resident.

How Much Is Travel Insurance for a Cruise?

The cost of your cruise travel insurance plan can depend on several factors:

- Trip Cost – Lower trip cost = lower premium

- Insurance Purchase Date – Purchasing closer to your departure date = lower premium

- Age – Younger traveler = lower premium

- Coverage – Less coverage = lower premium

- Benefit Upgrades – Fewer benefit upgrades added = lower premium

You can use our quote engine to quickly see and compare prices between our three Atlas Journey plans.

What Does Cruise Insurance Cover?

Cruise travel insurance protects nonrefundable investments related to your trip. It reimburses you if you have to cancel your international cruise unexpectedly, prior to your departure, due to a covered reason.

It also provides medical coverage for unexpected injuries and illnesses as well as trip protection benefits like reimbursement for lost baggage, delayed baggage, or a travel delay.

Here's an overview of a few key benefits you'll get when you purchase an Atlas Journey travel insurance plan from WorldTrips:

Trip Cancellation

The core of any good cruise travel insurance policy, trip cancellation coverage reimburses you for the full cost of your prepaid and nonrefundable travel expenses—up to your policy maximum—if you have to cancel your cruise due to a covered reason.

Here are some scenarios that are covered under Atlas Journey Elevate, Atlas Journey Explore, and Atlas Journey Escape:

- You fall ill or are unexpectedly injured and your physician insists that you cannot go on your cruise

- Your traveling companion or non-traveling family member falls ill, becomes injured, or dies unexpectedly and you have to cancel your trip

- Inclement weather causes the destruction of your accommodations, a delay of your common carrier for more than twelve (12) hours, or a cancellation from your common carrier, causing you to cancel your trip

- You or your traveling companion are directly involved in an accident (substantiated by a police report) that causes you to miss your cruise ship's departure

- A terrorist incident occurs in a city listed on your cruise itinerary and your cruise line is unable to modify its route (the incident must occur within the 30 days prior to your scheduled departure date)

- A natural disaster occurs unexpectedly in your destination and renders it uninhabitable

- A last-minute legal obligation, such as jury duty, requires you to remain in your home country

Note that these situations must occur after your policy goes into effect to be eligible for reimbursement.

Example of the Trip Cancellation Benefit in Use

You and two close friends are driving to Miami to board your cruise ship to Mexico when a truck runs a red light and slams into the front end of your car. Thankfully, none of you suffer life-threatening injuries, but paramedics insist on taking you to the hospital to check for internal injuries.

You're disappointed you won't make your cruise, but you're thankful you have a Trip Cancellation benefit. You'll get reimbursed for the nonrefundable payment you previously made for the cruise.

PRO TIP: Be sure to review the full list of eligible scenarios and exclusions in the policy documents for your plan.

Trip Interruption

The Trip Interruption benefit reimburses you if you are unable to continue your cruise due to one of the same situations covered under the Trip Cancellation benefit explained above.

Unlike the Trip Cancellation benefit, Trip Interruption provides you with reimbursement if one of these covered situations occurs after you depart on your cruise.

Example of the Trip Interruption Benefit in Use

Say you've just set foot on Paradise Island when you receive the devastating news that your father has passed away. Depending on the circumstances, you may wish to return home immediately.

Under the Trip Interruption benefit, you would be reimbursed for your unused, prepaid, and nonrefundable land or sea expenses. You would also be reimbursed for the additional transportation cost for you to reach your cruise ship's scheduled return port early.

Travel Delay

This benefit reimburses you for your covered expenses—up to the maximum benefit of your policy—if you are delayed for a certain number of hours due to a defined hazard.

Example of the Travel Delay Benefit in Use

Imagine heavy fog causes your initial cruise departure to be delayed until the following morning. Not only do you now need to find a last-minute hotel room and transportation, but you also have to pay for meals you hadn't accounted for when making your budget.

Luckily, your Travel Delay benefit reimburses you for the reasonable cost of accommodations, local transportation, meals, and telephone calls.

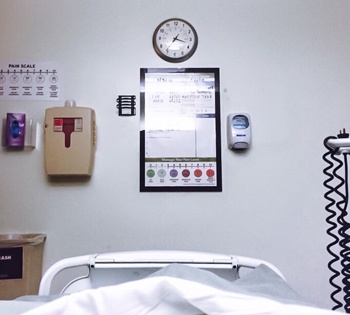

Emergency Accident and Sickness Medical Expense

The Emergency Accident and Sickness Medical Expense benefit covers health care expenses for necessary services and supplies required to treat a covered injury or illness.

Depending on your plan, a benefit like this could cover eligible expenses such as:

- Ambulance service

- Physician services

- Charges for cruise ship infirmary and prescribed medication

- Hospital room and board in one of your stopover destinations

- Charges for anesthetics, X-rays, and labs

Note that this benefit could be primary or excess depending on the plan. Primary means your cruise travel insurance pays your eligible claim first. Excess means this policy is in excess of all other insurance (like Medicare or another primary health insurance). If your other insurance is in place when the expenses are incurred, your cruise travel insurance will only cover the excess of the amount paid by your other insurance.

Example of the Emergency Accident and Sickness Medical Expense Benefit in Use

While touring your cruise ship's first destination, your child takes a nasty fall that requires a trip to the nearest emergency room.

Since you've been traveling by ship and don't have a car, you rely on a local ambulance to transport you and your child to the hospital. Once there, he is admitted for X-rays and later scheduled for surgery.

If your son's broken arm qualifies as a covered injury, your Atlas Journey plan will cover eligible expenses for the ambulance ride, physician consultation, X-rays, operating room, and hospital room and board charges up to the medical maximum.

How your Atlas Journey plan covers eligible expenses depends on the plan level you choose:

Atlas Journey Elevate

This plan’s Emergency Accident and Sickness Medical Expense benefit is primary. This means the policy will pay your eligible claim first—before another insurance policy.

Atlas Journey Explore

This plan’s Emergency Accident and Sickness Medical Expense benefit is also primary.

Atlas Journey Escape

This plan’s Emergency Accident and Sickness Medical Expense benefit is excess. This means the policy will provide coverage in excess of other available coverage.

Medical Evacuation & Repatriation of Remains

A Medical Evacuation & Repatriation of Remains benefit covers your physician-ordered, emergency air or ground transportation from a hospital or emergency care facility that is ill-equipped to treat you to the nearest hospital that can provide adequate care.

This benefit may also cover travel expenses home for your travel companion if you are expected to be hospitalized for 24 hours or more. If you are traveling with a minor, you could also get coverage for their necessary transportation, accommodations, and meals while you are being treated.

In the unfortunate event that you pass away during your trip, this benefit can also cover repatriation expenses to return you to your home.

Example of the Medical Evacuation & Repatriation of Remains Benefit in Use

You become seriously ill during your cruise. You visit your cruise ship's medical facility in the hope of being treated onboard, but it cannot provide the care you need. You must be transported to the nearest on-shore hospital that has sufficient equipment and the necessary specialists to treat you.

According to the CDC, emergency medical evacuations can be expensive, ranging from $25,000 to over $250,000.

Thankfully, you have an Atlas Journey plan which includes a Medical Evacuation & Repatriation of Remains benefit. Atlas Journey plans cover medical evacuation starting at $250,000, with the Atlas Journey Elevate plan benefit going up to $1,000,000.

How Do I Choose the Best Insurance?

The best cruise insurance is the plan that offers the benefits you need at a price you can afford.

WorldTrips offers trip cancellation coverage for cruises in three different plan levels, so you can choose the coverage and cost that are right for you:

Atlas Journey Elevate

Highest premium, highest benefit amounts

Atlas Journey Explore

Mid-level premium, mid-level benefit amounts

Atlas Journey Escape

Lowest premium, lowest benefit amounts

Click here to get an Atlas Journey travel protection quote in less than five minutes.

You'll fill in information about your age, residence, destination, departure date, return date, and trip payment. Then you'll be prompted to compare plans and make your selection—or save your quote so you can return to it later.

“WorldTrips is the best travel insurance company of 2024, based on our in-depth analysis of travel insurance policies."

Don’t Need Trip Cancellation Coverage? Consider Cruise Travel Medical Insurance Instead

Maybe you've already purchased insurance through your cruise line that covers a last-minute cancellation, or maybe you're not interested in the trip cancellation coverage that comes with a cruise travel insurance policy.

You may still wish to purchase medical insurance in case you need a life-saving medical evacuation or have to seek treatment for an injury or illness abroad. Cruise travel medical insurance policies can be budget friendly. In fact, an Atlas Travel policy starts at less than $1 a day. You'll also get supplementary travel benefits similar to some of those included in a cruise travel insurance policy, such as Trip Interruption and Travel Delay.

Cruise travel medical insurance plans like Atlas Travel are available to both U.S. and non-U.S. citizens, though you must be traveling abroad.

As Seen in

KHE2FFFYH6SP-971744701-1196

WorldTrips is a service company and a member of the Tokio Marine HCC group of companies.

WorldTrips’ Atlas Travel Series and StudentSecure international travel medical insurance products are underwritten by Lloyd's. WorldTrips has authority to enter into contracts of insurance on behalf of the Lloyd's underwriting members of Lloyd's Syndicate 4141, which is managed by HCC Underwriting Agency, Ltd.

WorldTrips' Atlas Journey, Atlas Cruiser, and Atlas On-The-Go trip protection insurance products are underwritten by Tokio Marine HCC's U.S. Specialty Insurance Company (USSIC). USSIC is a Texas-domiciled insurance company operating on an admitted basis throughout the United States. Coverage is available to U.S. residents of the U.S. states and District of Columbia only. This plan provides insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home, and automobile insurance policies. Coverage may not be available in all states.

In the State of California, operating as WorldTrips Insurance Services. California Non-Resident Producer License Number: 0G39705